Stockton may dodge pension battle if deals hold

September 30, 2013

Chances of the Stockton bankruptcy producing a landmark ruling to cut

pensions dimmed last week, when the city announced a deal with one bond insurer

and a tentative deal with another one.

The two big bond insurers, who unsuccessfully opposed Stocktonfs eligibility

for bankruptcy, argued that a city plan to cut bond debt was unfair because the

largest creditor, CalPERS, would be untouched.

U.S. Bankruptcy Judge Christopher Klein said the proper time to rule on the

CalPERS question is when the court considers whether all creditors are being

treated fairly by the city gplan of adjustmenth to cut debt and emerge from

bankruptcy.

Now Stockton may be taking big steps toward resolving the fairness issue by

negotiating a plan with creditors to exit bankruptcy as urged by the judge.

Klein brought in another bankruptcy judge, Elizabeth Perris, to conduct

mediation.

A debt-cutting plan

proposed by Stockton last week cited a tentative agreement with

National Public Finance Guarantee, backer of $89 million in bonds, and a draft

agreement awaiting approval by Assured Guarantee, backing $164 million in

bonds.

The Stockton city manager, Bob Deis, said the city has agreements with 14 of

19 major creditors. He said a gcram downh approach, which imposes debt cuts

opposed by creditors, will not occur until a court order is obtained.

Deis said the proposed plan of adjustment, scheduled for a City Council

vote Thursday, is the first step in a complicated process that could, in six

months, get Stockton out of the bankruptcy declared June 28 last year.

gWhile we expect further intense negotiations and court hearings, with

perhaps a set back here and there before this is over, this at least is the

beginning of the end,h Deis wrote in the plan. gIt provides the final piece in

our road back to putting our financial house in order.h

One of the remaining hurdles is getting voter approval of a ¾-cent sales tax

on Nov. 5. The plan said the alternative to Measure A is $11 million in

additional gbrutalh spending cuts and the loss of gnegotiating room to cut deals

with our creditors.h

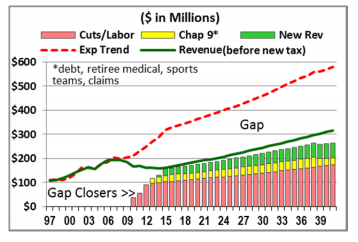

How Stockton plan would close general fund spending gap

The Stockton bankruptcy has been widely watched because of speculation that

public pensions, protected against cuts by state court decisions based on

contract law, might be reduced in federal bankruptcy court like other contract

debt.

If the city negotiates agreements that avoid a ruling on whether pensions

can be cut, the Stockton bankruptcy still may have produced an important ruling

on a growing retirement cost: retiree health care promised state and local

government workers.

Retiree health care often has a long-term debt or gunfunded liabilityh

similar to pensions. But most employers do not make annual pension-like

contributions to a retiree health fund, which can yield investment earnings to

help pay future costs.

The view that retiree health care is a benefit that can be cut may change.

This month a superior court

overturned a freeze on retiree health care for Los Angeles city

attorneys, citing the same contract case law that protects public pensions.

The new Los Angeles ruling, though limited and likely to be appealed, is

already having an impact.

gCourt ruling on retiree health benefits credit negative for Los Angeles,

could impact other California municipalities,h said a headline in a Wall Street

credit rating agency newsletter last week, Moodyfs Weekly Credit Outlook for

Sept. 26.

If it turns out that state law does indeed give promised retiree health care

the same protection as pensions, a ruling in the Stockton bankruptcy could be

important as desperate cities look at the option of bankruptcy.

Judge Klein, in a deeply researched 40-page

ruling last year, refused to temporarily block Stocktonfs elimination

of retiree health care while the city pursued eligibility for bankruptcy

(granted in April) and a debt-reduction plan to exit bankruptcy.

A Stockton retiree group argued that their promised retiree health care is a

vested right under federal and state contract law. Under federal law, Klein

said, a bankruptcy court cannot ginterfere withh the property or revenue of a

debtor.

In other words, the bankruptcy court cannot tell the debtor how to spend its

money. So Klein said he could not block the cut that gmay lead to tragic

hardships for individuals in the interval before their claims are redressedh in

a plan of adjustment.

The elimination of retiree health care for current workers and retirees is

one of the major savings in the proposed Stockton plan of adjustment released

last week.

gWhen I arrived in July, 2010, the unfunded actuarial accrued liability (for

retiree health care) was $544 million,h Deis wrote. gBy comparison, the

actuarial value of unfunded liability for the California Public Employees

Retirement System (CalPERS) for June 30, 2011, was $172 million.h

Stockton has said since filing for bankruptcy that it does not want to cut

CalPERS debt, arguing that pensions must be protected to keep the crime-ridden

city competitive in the job marketplace, particularly for police.

Last June the city

announced an agreement with a retiree group for a $5.1 million retiree

health care lump sum payment for an estimated 1,100 retiree claims, up from an

original proposal that would have given them nothing.

The proposed plan said Stockton has two groups of retirees, divided by a big

increase in benefits adopted by many local governments after a CalPERS-sponsored

bill, SB 400 in 1999, gave state workers a large, trendsetting retroactive

pension increase.

Workers who retired before Stockton gave employees a benefit increase early

last decade have an average pension of $24,000 and no retiree health care. Since

the increase, the average pension is $51,000 (most get no Social Security) with

a medical benefit worth $26,000 a year.

Stockton has negotiated agreements with all of its labor unions. The plan

estimated that the loss of retiree health care, pension reforms and pay cuts

reduces the total retirement benefit for current workers by 30 percent to 50

percent or more.

Current employees will pay the full employee share of the contribution to

the California Public Employees Retirement System, 7 to 9 percent of pay. New

employees get a lower pension under a state reform.

If Stockton can cut a deal with the bond insurers, the judge may not have to

determine whether the bond insurers are treated unfairly because the cuts for

Stockton retirees are not deep enough.

A tough opening position by Stockton has softened in negotiations. The new

plan said that under a deal in February, Ambac, backer of $12 million in bonds,

gets revenue from property tax growth and will not get a ghaircuth if assessed

values grow as expected.

National Public gets revenue from property tax growth that should gfully

serviceh a restructured deal on $45 million in arena bonds. New parking revenue

is expected to cover a deal on $32 million in bonds for three garages,

repossessed by National Public.

The draft deal with Assured for $124 million in unsecured pension bonds and

$40 million in bonds for a city hall building, repossessed by Assured, await

approval by Assured executives and were not revealed.

Reporter Ed Mendel covered the Capitol in Sacramento for nearly three

decades, most recently for the San Diego Union-Tribune. More stories are at

Calpensions.com. Posted 30 Sep 13

This entry was posted on

September 30, 2013 at 7:25 am and is filed under Bankruptcy, Retiree health, Stockton.